Introduction

It’s been an impressive run since the April 8th low, with the S&P 500 gaining more than 30% and experiencing minimal pullbacks along the way. Strong earnings, a resilient economy, the start of a rate-cutting cycle, ongoing AI investment and its potential productivity benefits, and the stimulative effects of the One Big Beautiful Bill Act (OBBBA) have all served as powerful tailwinds for the market.

That said, while economic growth remains solid, cracks are beginning to show. Inflation pressures and signs of labor market softness could intensify in either direction. A prolonged government shutdown or a disappointing jobs report could introduce volatility, but barring those shocks, the prevailing momentum still points higher.

Even so, this is not a time to become complacent, which is why we continue to emphasize diversification across client portfolios. By maintaining exposure to a range of asset classes and strategies, we aim to balance participation in market gains with protection against the inevitable periods of volatility that lie ahead.

Government Shutdown

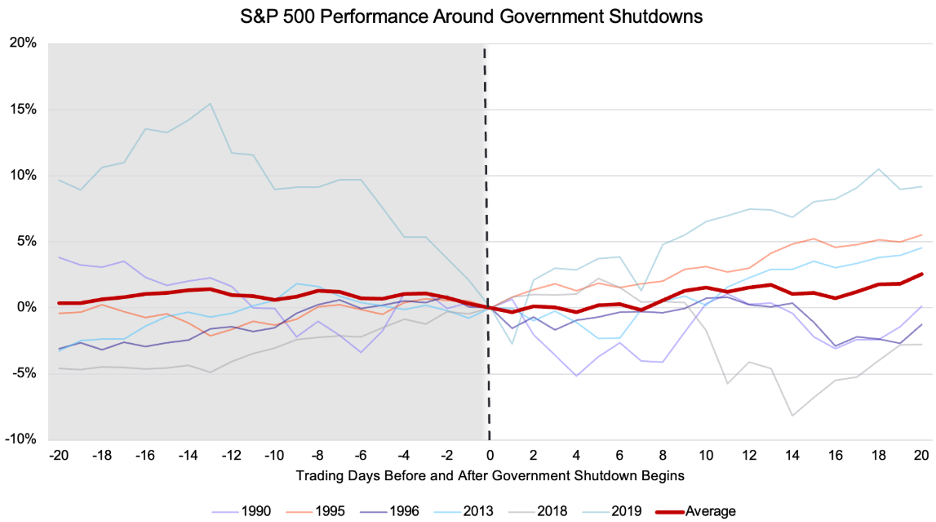

The U.S. government shut down on October 1st after Congress failed to pass appropriations legislation for the 2026 fiscal year. As of now, the government remains shuttered with prediction markets forecasting the shutdown will last around two weeks. This shutdown marked the first since late 2018-early 2019 when the U.S. government closed for 35 days.

Historically, government shutdowns have not had much impact on financial markets. In the past six shutdowns from 1990 through 2019, the average shutdown lasted a total of 14 days. Over these time periods, the S&P 500 rose 1%, market volatility was unchanged, and the 10-year Treasury yield fell 4 basis points.

The Economy

Economic growth snapped back last quarter after posting a negative print in the preceding quarter. Net exports surged quarter-over-quarter after firms frontloaded imports in Q1 ahead of April’s tariff announcement. Consumer spending remained strong, growing at a 2.5% annualized pace, while business investment was aided by spending on the energy and data center buildout. All told, economic growth expanded at a 3.8% annualized pace. Economists expect above-trend growth to continue, with the consensus estimate calling for 3.0% annualized growth in Q3.

The labor market presented a less optimistic picture as job growth slowed considerably over the third quarter. The non-farm payrolls report averaged just 30,000 monthly job adds the past three months, down considerably from 100,000 the three months prior. The unemployment rate also ticked up to 4.3%, the highest level since late 2021. A slowdown in hiring due to uncertainty over tariff policy and artificial intelligence is colliding with a decline in the labor supply as immigration policy becomes more restrictive. Despite the lack of job creation, layoffs remain low, and wage growth continues to outpace inflation. The economy is likely to remain in a “low hire, low fire” environment for the rest of 2025.

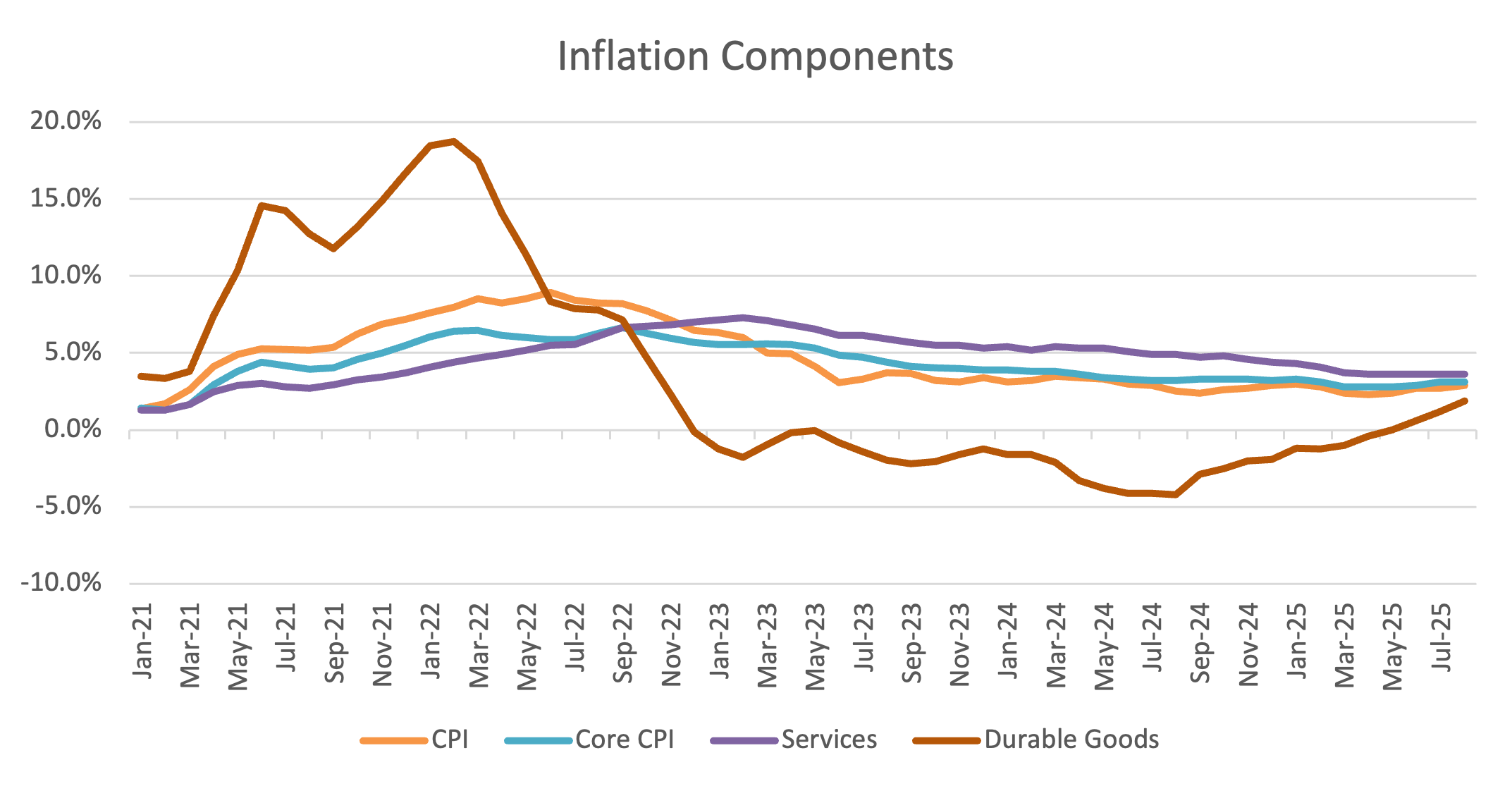

Finally, inflation moved higher in the third quarter due to sticky services inflation and rising goods prices. The Consumer Price Index (CPI) printed a 0.4% increase in August and was up 2.9% over the past year. Goods prices increased 1.5% over the past year as tariff impacts began to show up in inflation data. Services prices, largely made up of shelter costs, rose 3.6% over the past year, above the pre-COVID trend of 3.0%. Inflation is projected to peak in the low 3% range in the next six months as tariffs inflict a one-time price increase. Price pressures are expected to ease throughout 2026, ending the year in the mid 2% range.

The Federal Reserve

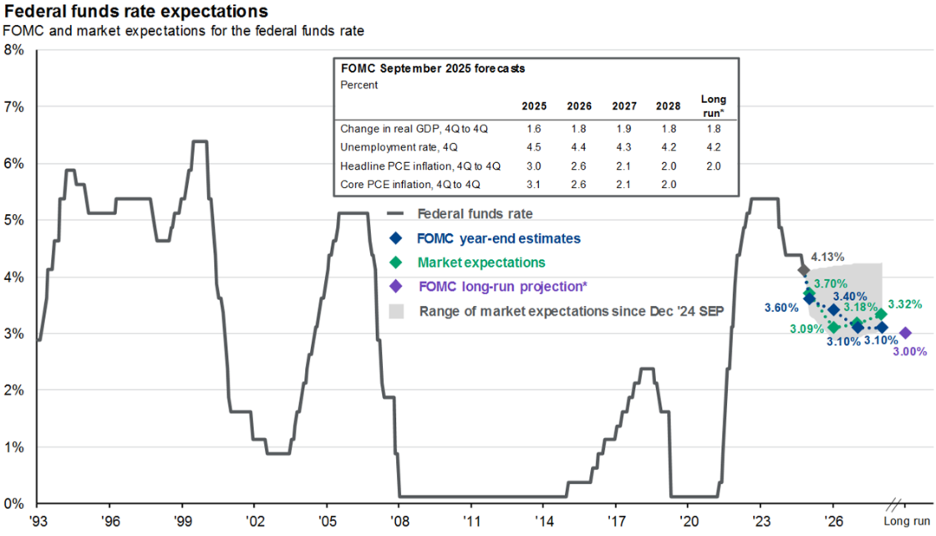

The Fed lowered interest rates for the first time in 2025 at their September meeting, cutting the policy rate from 4.4% to 4.1%. After implementing 100 basis points of cuts in late 2024, the Fed remained on hold for the first eight months of 2025. The softening labor market over July and August prompted the Fed to abandon its wait-and-see approach and institute a “risk management” cut. The Fed’s dot plot and market futures both point to two more cuts in 2025, bringing the policy rate to 3.6% by year end.

The Fed also published their quarterly Summary of Economic Projections at their September meeting. The economic outlook was little changed from their previous release. The committee expects 1.6% economic growth in 2025 followed by 1.8% growth in 2026. The unemployment rate is expected to peak at 4.5% in late 2025 before easing to 4.4% in 2026. Finally, core PCE, the Fed’s preferred measure of inflation, is expected to peak at 3.1% in late 2025 before declining to 2.6% by the end of 2026.

The Fed has a tricky road ahead of them. Inflation is above target, and growth appears to be solid which would indicate they should hold rates. At the same time, a weakening labor market and outside political pressure indicate a cutting cycle is ahead. It is likely the Fed will tolerate above target inflation to stem any further deterioration in labor markets. This points to a string of rate cuts over the coming quarters, pushing the policy rate down towards 3% by the end of 2026.

Artificial Intelligence / Equities

The continued hype surrounding artificial intelligence (AI) drove markets higher over the third quarter. The start of the AI bull market is generally seen as November 30th, 2022, with the initial release of OpenAI’s ChatGPT. Over nearly three years since then, the Nasdaq 100, an index with heavy exposure to AI stocks, gained a cumulative 109% while the Dow Jones Industrial Average, an index with limited AI exposure, rose 41%.

The third quarter was no exception as the Nasdaq 100 increased 9.0% while the Dow Jones Industrial Average trailed, rising 5.6%. AI-exposed companies continued to appreciate faster than the overall market with GPU developer Nvidia climbing another 18% and cloud provider Oracle surging 29%.

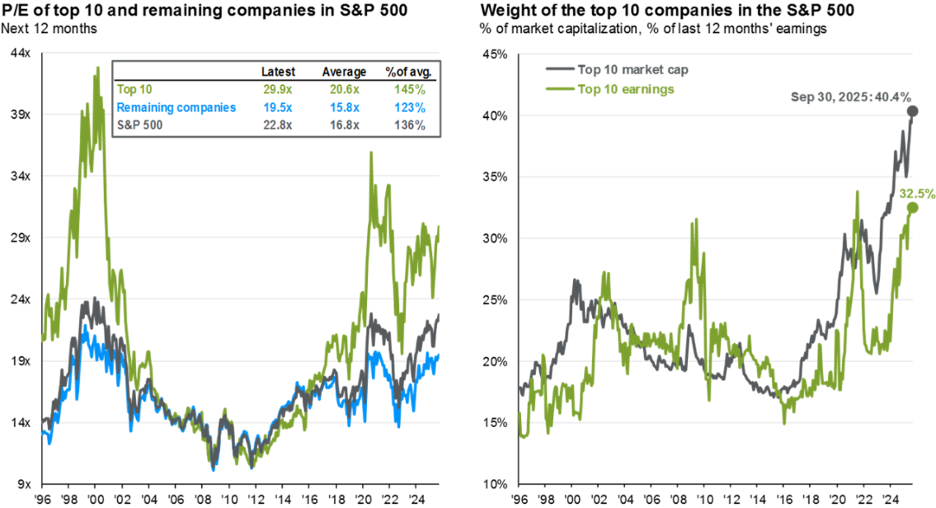

The outsized performance of these names has left market-cap weighted indexes heavily exposed to the AI theme. 40% of the S&P is invested in just ten stocks and 35% of the index is allocated to the technology sector. Defensive sectors such as health care and consumer staples are reaching their lowest weights in the index in decades.

While AI shows promise, it is reaching levels within the indexes that leave investors exposed if a technology-driven drawdown, like the one in 2022, were to occur. To protect against this, we are balancing allocations to technology and AI with allocations to quality, defensive large cap stocks as well as small cap equities. Both areas of the market trade at significant discounts to the S&P 500 and could provide downside protection in the event of a selloff.

On the corporate profits front, earnings grew for a ninth consecutive quarter, rising 12% year over year. While technology and communication services sectors continued to post outsized growth, financials and health care managed to provide solid numbers, with earnings in those sectors increasing 13% and 8%, respectively. Looking ahead, analysts expect 8% growth over the rest of this year. This would result in calendar year profit growth of 11% for 2025, above the long-term average of roughly 8%.

Elsewhere, international markets failed to keep pace with U.S. stocks in the third quarter. The MSCI ACWI ex USA returned 6.7%, slightly trailing the S&P 500’s 8.1% return. However, international markets have delivered year-to-date, rising 26.4% versus the S&P 500’s 14.8% return. A weakening U.S. dollar and a resurgence in European stocks have driven most of the outperformance for the year.

Fixed Income & Alternatives

Fixed income posted solid returns in Q3 with the Bloomberg U.S. Aggregate Bond gaining 2.1% and the Bloomberg Municipal Bond increasing 2.8%. Interest rates moved lower in anticipation of rate cuts, with the 10-year Treasury Note yield falling 10 basis points to 4.15%. The modest decline in rates paired with coupon payments resulted in low-single digit returns for investment-grade fixed income portfolios.

Despite shaky labor market data, credit spreads were well behaved in Q3 as strong equity returns, and solid corporate earnings provided an attractive credit backdrop. High-yield spreads, the additional amount less creditworthy borrowers must pay on their debt, are near record lows of just 280 basis points. High absolute yields, steady credit spreads, and low default rates resulted in solid returns for lower credit strategies such as high yield corporate bonds and bank loans in Q3.

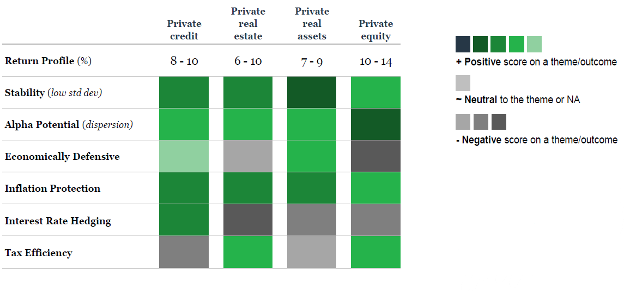

With equity market indexes at record levels of concentration and credit spreads tight, we continue to search for investments that can provide diversification while still offering an attractive level of return. One area we have been increasing our focus is infrastructure. This asset class invests in essential assets that are less correlated to economic and market cycles. Low downside risk paired with consistent income and upside potential make infrastructure a great diversifier within portfolios.

Another area of the market we have been allocating to when appropriate is mid-market buyout private equity. The largest stocks within public market indexes trade around 30x their next twelve months’ earnings. This is well above the long-term average of 20x. Mid-market buyout companies, which are typically firms generating between $25 million and $100 million in annual profit, are priced closer to 12x earnings. Lower valuations, diversification from the largest companies in public market indexes, and the potential for significant capital appreciation make mid-market buyout an attractive allocation within a diversified portfolio.

Conclusion

While the market backdrop remains broadly constructive, it is increasingly shaped by crosscurrents that warrant vigilance. The combination of strong equity performance, concentrated leadership, a complex economic environment, and evolving monetary policy creates both opportunities and vulnerabilities. Momentum may continue to drive markets higher in the near term, but history reminds us that periods of rapid gains are often followed by bouts of volatility.

Rather than implementing sweeping portfolio shifts, our view is that this is a time for measured positioning. Maintaining diversification across asset classes and strategies remains critical, not only to participate in further upside, but also to buffer against sudden shocks from unforeseen events or shifts in investor sentiment. In short, the path ahead still looks favorable, but it is narrowing. A disciplined approach will be essential as markets navigate the next phase of this cycle. Furthermore, we continue to look for differentiated investment themes and potential returns that can meaningfully participate on the upside while providing protection should markets turn.

IMPORTANT DISCLOSURES

The views, opinions and content presented are for informational purposes only. The charts and/or graphs contained herein are for educational purposes only and should not be used to predict security prices or market levels. The information presented in this piece is the opinion of Aurdan Capital Management and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but we cannot guarantee the accuracy or completeness of the information, no liability is accepted for any inaccuracies, and no assurances can be made with respect to the results obtained for their use. The information contained herein may be subject to change at any time without notice. Past performance is not indicative of future results.