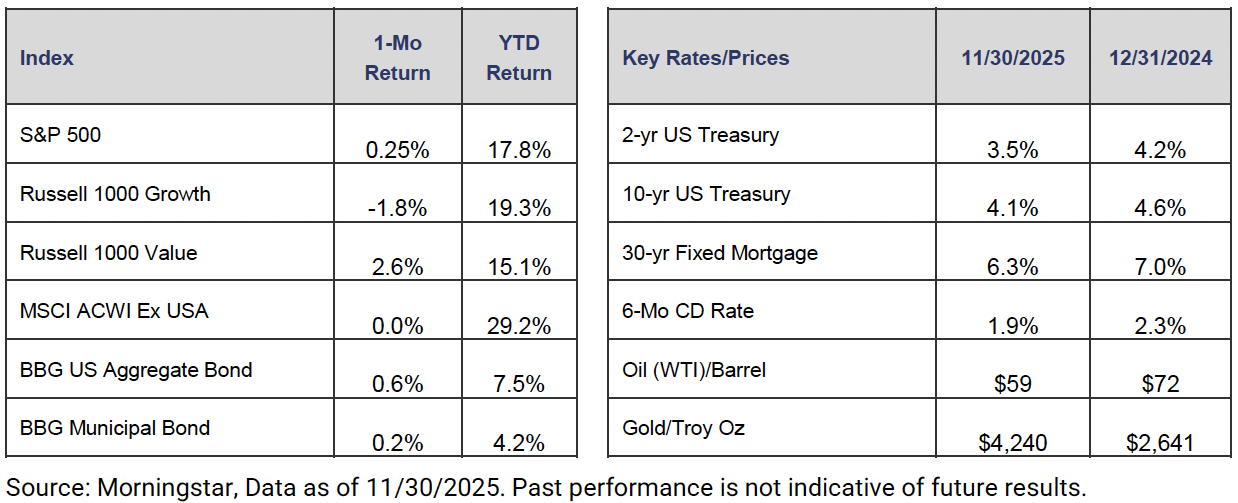

Markets rebounded sharply during the short holiday week, reversing early-November weakness and pushing the S&P 500 into positive territory for the month—marking seven consecutive months of gains. Momentum strengthened as expectations for a potential December rate cut increased. Notably, AI- and tech-focused growth stocks did not lead the rally and finished the month in negative territory. International equities paused after a strong stretch and were flat for the month, though they remain the standout performers year-to-date, up nearly 30%. Investment-grade fixed income continued to deliver steady results, with the Bloomberg U.S. Aggregate Bond Index and Bloomberg Municipal Bond Index returning 0.6% and 0.2%, respectively.

Earnings season has largely concluded. For Q3 2025, S&P 500 earnings grew 13.4%, the fourth consecutive quarter of double-digit earnings growth. Most companies reported upside surprises on both earnings and revenues.

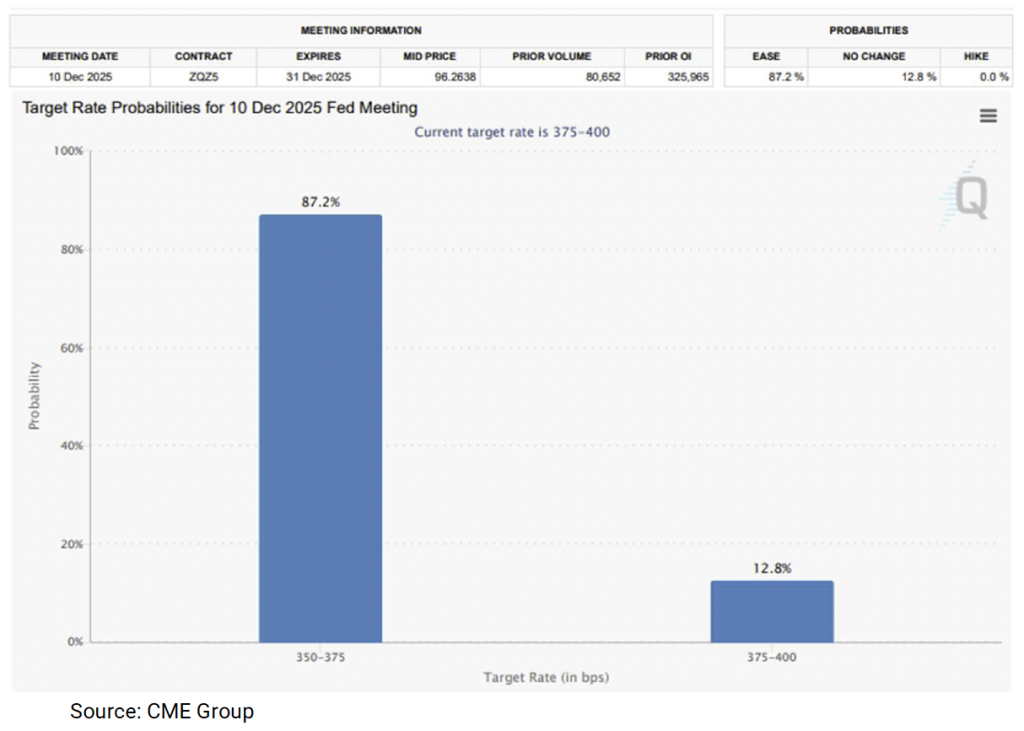

After 43 days, the longest government shutdown in U.S. history has ended. As December begins, markets are reconnecting with key economic data that has been delayed. These upcoming releases will reestablish the fundamental drivers of market direction. Strong readings on inflation, jobs, manufacturing, or services could support a bullish year-end outlook; however, any meaningful softness could quickly weigh on sentiment. Inflation remains a particular focal point, and the upcoming PCE report is expected to heavily influence expectations heading into the Fed’s December 9–10 meeting. Despite the data to come, expectations for a rate cut have increased dramatically over the past month to an 87% chance. At the end of last month, the probability was at 63%.

IMPORTANT DISCLOSURES

The views, opinions and content presented are for informational purposes only. The charts and/or graphs contained herein are for educational purposes only and should not be used to predict security prices or market levels. The information presented in this piece is the opinion of Aurdan Capital Management and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but we cannot guarantee the accuracy or completeness of the information, no liability is accepted for any inaccuracies, and no assurances can be made with respect to the results obtained for their use. The information contained herein may be subject to change at any time without notice. Past performance is not indicative of future results.