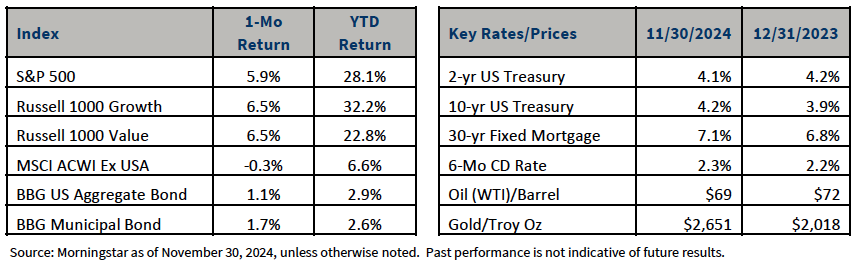

Stocks pushed higher over the course of November, propelled by the conclusion of the 2024 election and another rate cut by the Federal Reserve. The S&P 500 rose 5.9% over the month as value and growth stocks both popped 6.5%. Small caps were the biggest benefactor, with the Russell 2000 rising 11.1%, while international stocks struggled as the MSCI ACWI Ex USA Index fell 0.3%. Fixed income returns were positive as treasury yields ended the month slightly lower. The Bloomberg U.S. Aggregate Bond rose 1.1% while the Bloomberg Municipal Bond gained 1.7%.

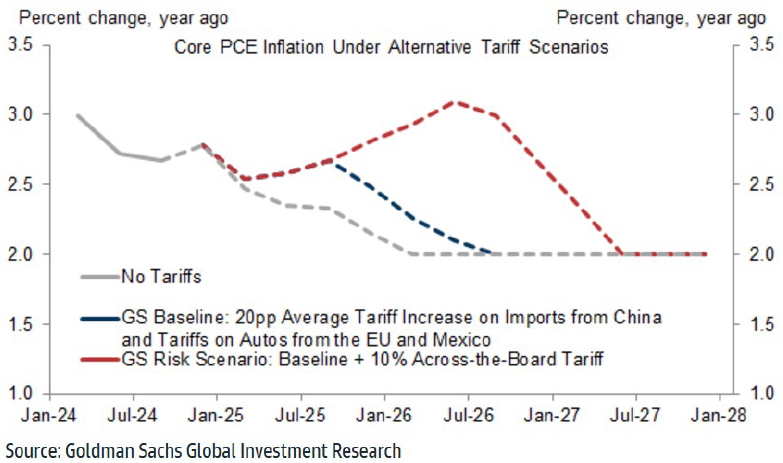

The Republicans won the White House as well as both chambers of Congress. The majority will give the Republicans cover to push through their agenda, which is likely to focus on trade, immigration, and taxes. President-elect Donald Trump used tariffs in his first term as a bargaining tool to extract concessions from trading partners. This appears to be his strategy again, with Trump recently threatening tariffs on Mexico, Canada, and China. The flow of migrants across the border is also likely to slow as Republicans place greater focus on restricting illegal immigration. The recent policies surrounding tariffs and immigration are inflationary in nature, with tariffs leading to increased goods prices and less migrant workers resulting in higher wage growth. However, the effects of these policies on inflation appear manageable, with Goldman Sachs estimating a one-time increase in prices to the tune of 0.3-0.4%. This scenario would result in core inflation finishing 2025 at 2.4% instead of 2.1%.

Taxes are also on the agenda in 2025, with the Tax Cut & Jobs Act (TCJA) sunsetting at the end of the year. Republicans will push to extend these tax cuts, which will leave income tax brackets at their current levels. Trump also campaigned on lowering the corporate income tax from 21% to 15%. Both policies are pro-growth, resulting in more capital for consumption and investment. However, both policies will also lower future government revenue, which will keep the deficit elevated in future years. While topics of deficit spending and the national debt are taking a backseat for now, the U.S.’s current fiscal path is unsustainable over the long-term and will need to be addressed at some point in the future.

As always, if you have any questions or concerns regarding your portfolio, please reach out to a member of our team. We hope everyone has a happy holiday season as we finish out 2024 and look forward to 2025!

IMPORTANT DISCLOSURES

The views, opinions and content presented are for informational purposes only. The charts and/or graphs contained herein are for educational purposes only and should not be used to predict security prices or market levels. The information presented in this piece is the opinion of Aurdan Capital Management and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but we cannot guarantee the accuracy or completeness of the information, no liability is accepted for any inaccuracies, and no assurances can be made with respect to the results obtained for their use. The information contained herein may be subject to change at any time without notice. Past performance is not indicative of future results.