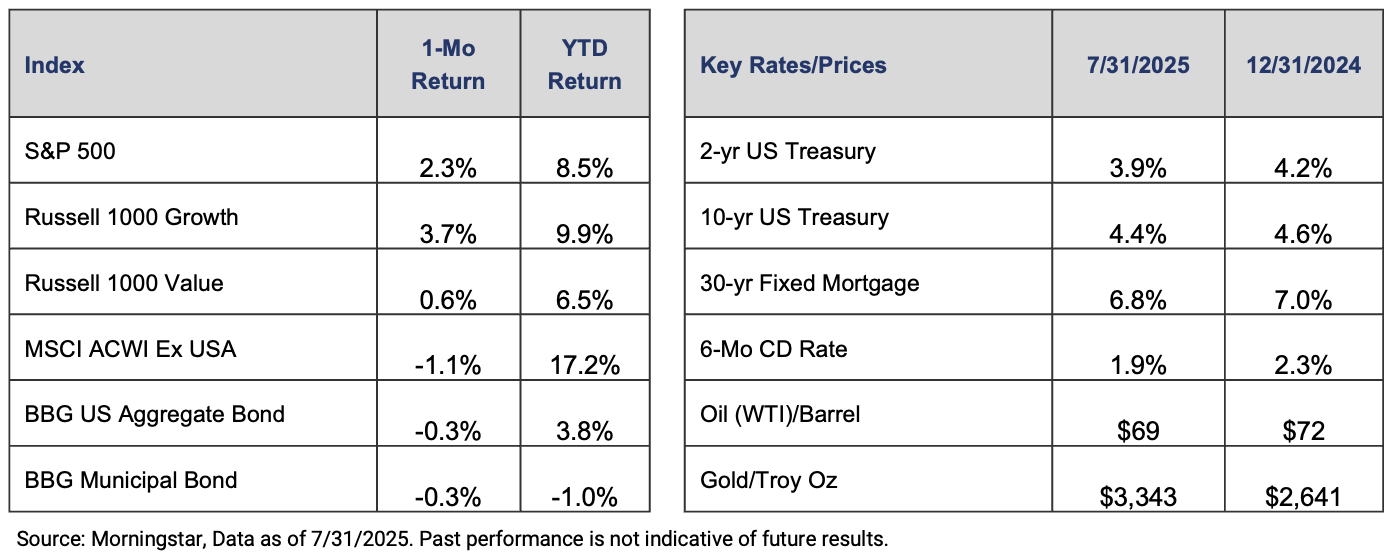

U.S. stocks notched their third consecutive month of gains in July. The S&P 500 rose 2.3% and closed the month near record highs. Growth outpaced value as artificial intelligence (AI) stocks propelled the market higher with AI darling Nvidia surging 12.6% over the month. International stocks trailed U.S. equities as the dollar strengthened 3.2% over the course of July. Finally, the 10-year Treasury Note yield rose 10 basis points to end the month at 4.4%. Rising rates led to small declines in core bond portfolios.

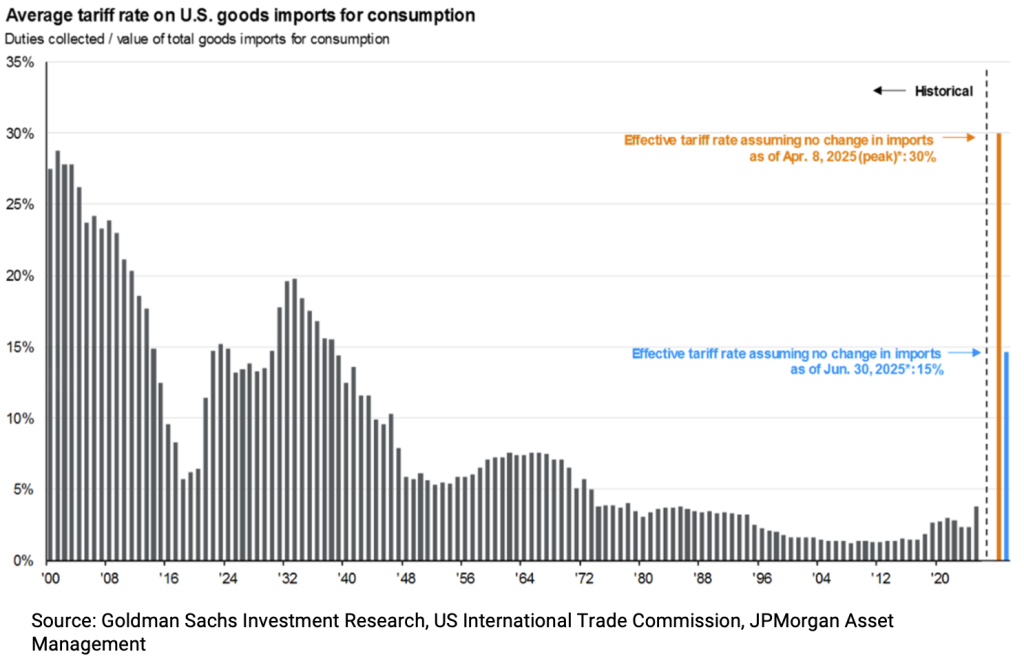

Trade news dominated headlines this month, with the U.S. securing several deals. Japan and the EU both signed new agreements with the U.S. which will set tariff rates at 15% for most imported goods. Both Japan and the EU pledged to invest hundreds of billions of dollars in the U.S. over the coming years while the EU also agreed to increase their purchases of U.S. energy products. The agreements followed similar understandings with the U.K. and Vietnam which saw their tariff rates set at 10% and 20%, respectively.

While the EU is America’s largest trading partner, the U.S. has yet to secure trade deals with its next three largest partners in Mexico, Canada, and China. Given the recent deals signed by the Trump administration, it seems likely that any future agreements with these countries will come with tariff rates in the 15-20% range.

The market has largely looked through disruptions caused by tariffs as investors determined a ~15% effective tariff rate is not high enough to cause unavoidable negative shocks to the economy. Tariffs have negative economic consequences as they lead to a one-time price increase and raise uncertainty which can lower growth. However, a ~15% tariff rate on $3.1T of annually imported goods could result in an additional ~$400b in government revenue per year. This increased revenue could be used to offset some of the cost of the recent tax breaks implemented through the One Big Beautiful Bill Act.

IMPORTANT DISCLOSURES

The views, opinions and content presented are for informational purposes only. The charts and/or graphs contained herein are for educational purposes only and should not be used to predict security prices or market levels. The information presented in this piece is the opinion of Aurdan Capital Management and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but we cannot guarantee the accuracy or completeness of the information, no liability is accepted for any inaccuracies, and no assurances can be made with respect to the results obtained for their use. The information contained herein may be subject to change at any time without notice. Past performance is not indicative of future results.