Introduction

As 2025 comes to a close and 2026 begins, financial conditions have eased around the world, led by central banks lowering interest rates in virtually every major economy. This shift, along with other factors, has supported strong equity markets globally, tightened credit spreads, and provided ample availability of credit. Notably, the S&P 500 posted its third consecutive year of double digit returns, finishing the year up more than 17%.

Strong earnings growth—led by the technology sector but not solely concentrated there—has also supported financial markets. The broadening of earnings growth beyond tech has been accompanied by expanding valuation multiples, driven largely by expectations surrounding artificial intelligence (AI). While it remains uncertain how fully AI will transform businesses, there is reason for optimism. AI shows promise not only in improving scientific research and drug discovery, but also as a developing general purpose technology with applications across industries to enhance productivity and efficiency. The expansion in equity valuation multiples has been, in part, an expression of that optimism.

At the same time, reasons for caution remain. Elevated equity valuations, evolving conditions in the real economy, and geopolitical risks all have the potential to increase investor uncertainty. Against a backdrop of policy unknowns, persistent inflation pressures, a softening labor market, and record-high public debt, the equity markets in 2026 will require a clear assessment of risk and reward across a range of possible outcomes.

Navigating this complex landscape will require a thoughtful balance between cyclical forces and longer-term structural shifts. The year ahead presents both opportunity and challenge for investors—and reinforces the importance of staying informed, diversified, and prepared for the unexpected.

The Economy

Economic growth continued to surprise to the upside this past quarter, with the economy expanding at an annualized pace of 4.3% in Q3. Consumer spending remained strong and business investment benefited from the AI and data center build out. The Federal Reserve (Fed) expects the post-COVID economic expansion to continue for the sixth year, penciling in 2.3% real GDP growth in 2026.

In addition to the resilient consumer and AI-related investment, fiscal stimulus should enhance growth next year through measures passed in the One Big Beautiful Bill Act. These include increased tax refunds and favorable tax treatment of business investment within the U.S. Monetary policy will also remain accommodative with the Fed expected to lower interest rates two more times next year. Other economic tailwinds include a five-year low in gasoline prices and a weaker dollar which should help U.S. exports.

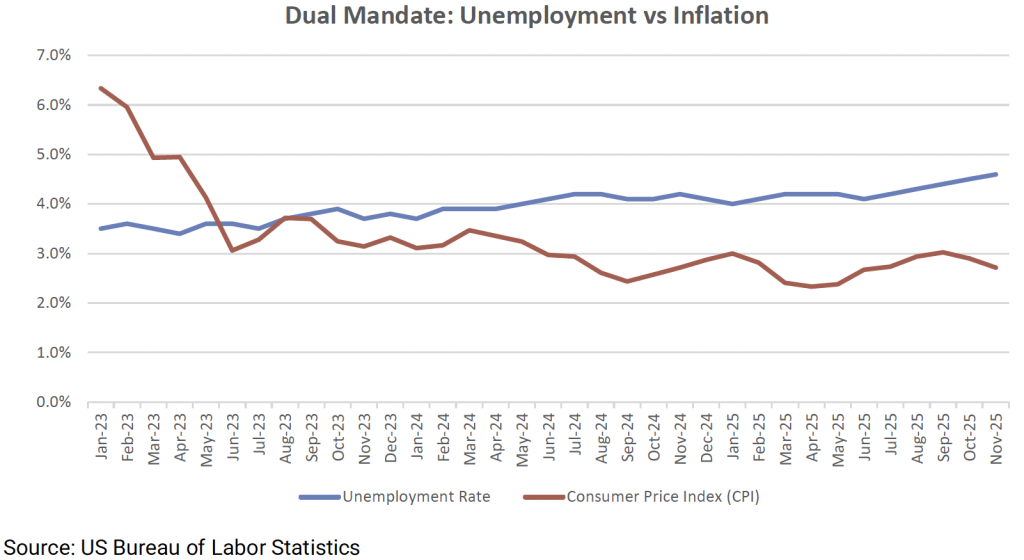

While the outlook looks rosy, there are notable headwinds moving into 2026, with the largest being a slowing labor market. The economy has been in a “low hire, low fire” environment for the better part of two years. The unemployment rate increased 0.5% over the past 12 months to end 2025 at 4.6%, a four year high. If layoffs pick up and hiring remains subdued, consumer spending could stall.

Another potential headwind is a pullback in AI investment. The AI buildout has been the second largest driver of economic growth over the past two years behind consumer spending. Households have also benefited from higher asset prices largely due to the runup in technology and AI stocks.

Finally, tariffs could return to top of mind if the Trump administration decides to ramp up pressure on larger trading partners like China or the European Union. Tariff-related inflation was less severe than forecasted in the back half of 2025. Still, the consumer price index (CPI) increased 2.7% year-over-year in November, which is above the Fed’s target of 2.0%.

On balance, the economic outlook has more tailwinds than headwinds heading into 2026. This makes us optimistic that the bull market run in stocks can continue for its fourth year. However, we remain vigilant of the headwinds mentioned above and will act tactically as opportunities present themselves.

The Federal Reserve

The Fed met market expectations in 2025 by delivering three interest rate cuts. Like 2024, the Fed was on hold for the first eight months of the year before lowering interest rates in September, October, and December. Short-term rates measured by the 3-month Treasury bill are now at 3.6%, nearly 200 basis points below the October 2023 peak of 5.5%.

Looking ahead, the Fed expects just one cut in 2026 while the market is anticipating two cuts. The road ahead is much more difficult for the committee with unemployment moving higher while inflation remains above target. The Fed may be reluctant to cut in the first half of the year, but we expect them to continue easing in the second half as inflation laps the tariff impacts of 2025 and a new Fed chair, who is likely to lean more dovish than current chair Jerome Powell, takes over in May.

Equities

U.S. stocks closed out their third impressive year in a row with the S&P 500 climbing over 17%. The strong 2025 follows a 25% return in 2024 and a 26% increase in 2023, resulting in a three-year cumulative return of 85%.

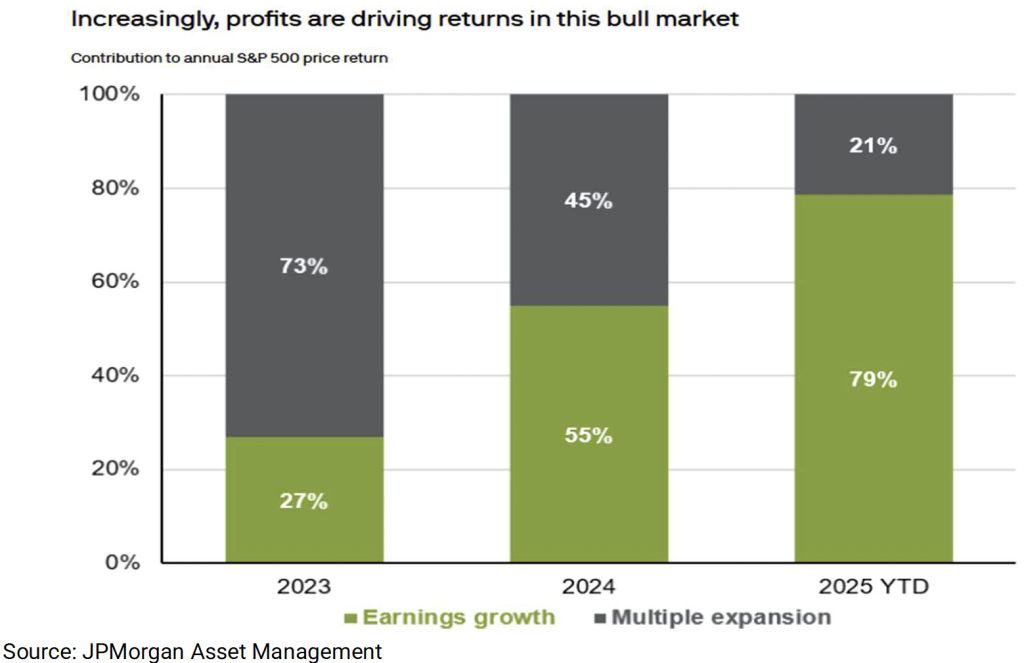

Equity index returns can be broken down into three components: dividend yield, earnings per share (EPS) growth, and multiple expansion/contraction (effectively the change in price investors are willing to pay for the index). The current dividend yield of the S&P 500 is a mere 1%, so we will focus on earnings growth and multiple expansion.

In 2022, the S&P 500 declined nearly 20%, leaving the index trading at a depressed multiple. The multiple snapped back in 2023 as investors scooped up cheap shares of technology stocks and the economy held up better than expected despite a rapid rise in interest rates. The multiple continued to expand in 2024 as the economy grew but EPS growth also came back to life, contributing about half of the S&P 500’s 2024 return.

This past year EPS growth took over as the primary driver of returns as the AI build out supercharged earnings growth while the S&P 500’s multiple had already climbed to the highest level since the late 1990s.

Looking to 2026, returns will probably look more like 2025 than 2023. The S&P 500 is already trading at 22x forward earnings, nearly two standard deviations above the long-term average of 17x. This means multiple expansion is unlikely to be a tailwind moving forward and may even become a headwind should multiples move closer to the long-term average. The good news is earnings are expected to grow 15% next year, with technology and AI stocks expected to grow nearly 20% and the rest of the market growing around 10%.

Despite the rosy earnings outlook, the index remains expensive and could pull back if sentiment sours. The two main risks are a growth scare and a slowdown in AI investment. If unemployment continues higher and consumers shy away from spending, multiples are likely to rerate lower. Further, 40% of the S&P is now invested in technology and AI-related stocks. Any sort of pullback in investment or sentiment around AI will see the index move lower.

Finally, after years of waiting, the fruits of equity diversification made a long-awaited return this year with international equities outperforming U.S. equities for the first time since 2017. A weakening dollar and fiscal expansion in Europe led to a 32% return for the MSCI ACWI Ex USA in 2025. Despite the sizable return, international indexes remain much cheaper than their US peers, with the MSCI ACWI Ex USA trading at just 15x forward earnings. Brightening earnings outlooks overseas, cheaper valuations, and continued pressure on the dollar are reasons we recommend maintaining international exposure in 2026.

Fixed Income

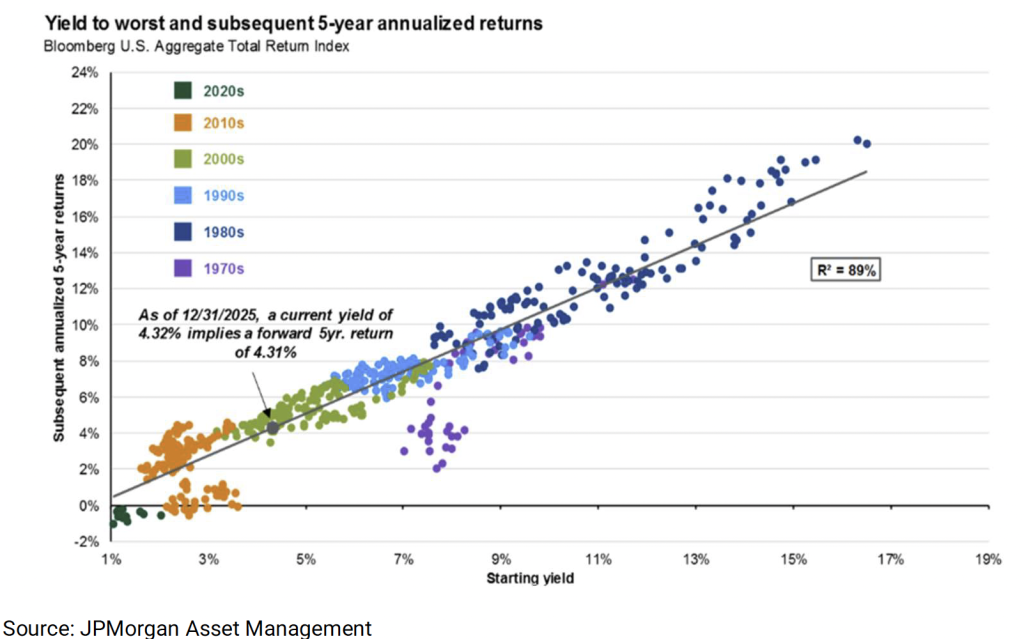

Fixed income also had a stellar 2025 with the Bloomberg US Aggregate Bond Index (AGG) posting its best return since 2020. The AGG rose 7% this past year with income making up about 4% and price appreciation from declining interest rates making up the other 3%. The best predictor of future returns in fixed income is the starting yield to maturity and the AGG is currently yielding 4.5%. This is a much more attractive proposition for investors looking for income and protection compared to the 2010s and early 2020s.

However, like in equity markets, risks remain. Credit spreads are near the tightest levels on record, leaving investors exposed to the downside should economic growth slow. The U.S.’s fiscal deficit and debt level are also beginning to flash warning signals. We continue to own fixed income for balanced and conservative investors, providing ballast and income to portfolios. We are emphasizing an up-in-quality approach and overweighting the short and intermediate sections of the yield curve.

Alternatives

We acknowledge there is a lot to be optimistic about as we enter 2026. However, asset prices now reflect this optimism. Equity markets are concentrated and expensive while credit spreads are near the tightest levels on record. The easy option to diversify away the risks we see in markets today would be to simply hold Treasuries and cash. While these asset classes provide diversification from stocks and credit, investors are sacrificing potential return to achieve this diversification.

We look outside of traditional public stock and bond markets to provide additional diversification without sacrificing potential return. Three asset classes we have reviewed this past year are private equity, private credit, and infrastructure. Infrastructure is an asset class we like to mitigate downside risks found in public markets while still possessing the potential of achieving a high-single digit return. Infrastructure invests in essential assets that are typically uncorrelated with the business cycle. These assets can also act as an inflation hedge as their value tends to increase in times of elevated price pressures. Further, infrastructure is experiencing multiple tailwinds at the moment from the reshoring of U.S. manufacturing, the data center and AI boom, and the renewable energy buildout.

Technology is rapidly allowing private wealth investors to access asset classes once reserved for pension plans and sovereign wealth funds. We will continue to research these asset classes outside of traditional stocks and bonds to help give client portfolios an edge.

Conclusion

As we enter 2026, the investment landscape remains constructive but increasingly complex, with strong economic momentum and earnings growth balanced by elevated valuations and emerging risks. While equities continue to be supported by fundamentals—particularly in technology and AI—future returns are likely to be driven more by earnings than by valuation expansion, underscoring the importance of selectivity and diversification. Fixed income once again offers meaningful income and portfolio stability, though discipline around credit quality remains essential. Given rich pricing across traditional asset classes, we believe a diversified, actively managed approach that incorporates select alternatives can help manage risk while positioning portfolios for durable, long-term returns.

Reflecting on the past year, we are proud of Aurdan’s continued success and growth. We celebrated our one year anniversary in June, welcomed our first hire—Sara Turner, Director of Wealth Planning—and had the privilege of partnering with many new clients. These milestones mark an important foundation for the firm, and we are grateful for the trust our clients have placed in us. Looking ahead, we are excited about the opportunities before us and remain focused on building thoughtfully, investing in our team, and delivering positive outcomes over the next twelve months.

IMPORTANT DISCLOSURES

The views, opinions and content presented are for informational purposes only. The charts and/or graphs contained herein are for educational purposes only and should not be used to predict security prices or market levels. The information presented in this piece is the opinion of Aurdan Capital Management and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but we cannot guarantee the accuracy or completeness of the information, no liability is accepted for any inaccuracies, and no assurances can be made with respect to the results obtained for their use. The information contained herein may be subject to change at any time without notice. Past performance is not indicative of future results.