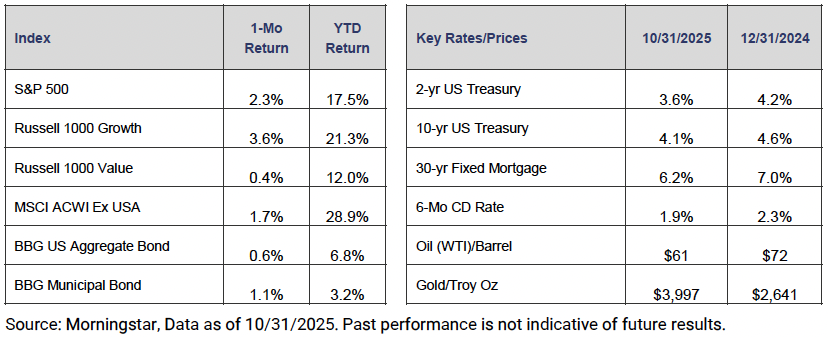

U.S. stocks continued higher in October, with the S&P 500 gaining 2.3% and ending the month near all-time highs. Artificial intelligence (AI) companies continued to lead the way with the Magnificent Seven, a basket of mega-cap technology stocks, rising 4.8%. Moving overseas, international stocks posted a solid month, increasing 1.7%. The strong return was led by emerging market technology companies that stand to benefit from the AI buildout. Investment-grade fixed income got in on the action as well with the Bloomberg US Aggregate Bond and Bloomberg Municipal Bond indexes each returning roughly 1.0%. Increasing odds of rate cuts and a decline in longer-term rates lifted bond prices in October.

The government shutdown entered its fifth week and looks set to break the record for longest shutdown. The record came in early 2019 after the government was shuttered for 35 days. For now, the market is taking the shutdown in stride with the S&P 500 and Bloomberg Aggregate Bond up 2.3% and 0.6% since the government shut its doors.

Tariffs were also front-and-center this month as President Trump and President Xi met in South Korea. Earlier this month, China threatened to further restrict rare earth exports while the U.S. toyed with the idea of increasing Chinese tariffs to 100%. For now, these measures appear to have been avoided, and hope is building that a comprehensive trade deal can be accomplished in the coming months.

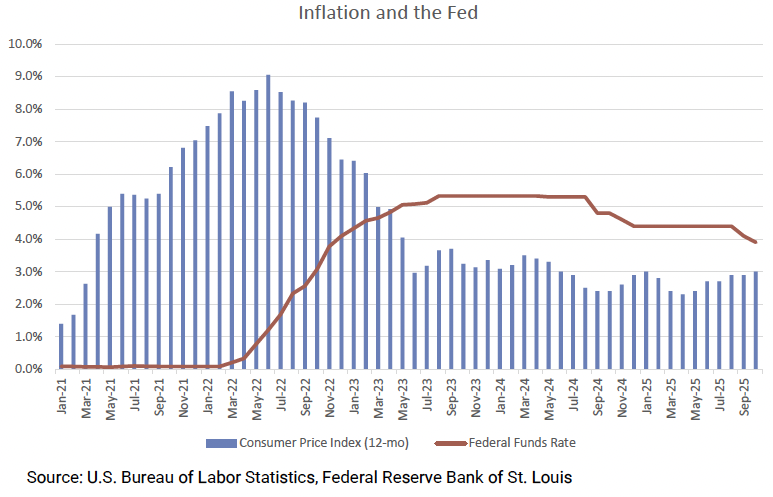

In addition to news surrounding the shutdown and tariffs, a driver of returns over the past month was the September Consumer Price Index (CPI) release. The report showed inflation was more subdued than expected, with CPI rising 0.3% in September and 3.0% over the past year. Notably, services inflation, which captures price data from areas such as shelter and insurance, rose at its slowest annual pace since November 2021. Investors are anticipating the current rate-cutting cycle will continue with markets penciling in three more cuts over the next 12 months.

IMPORTANT DISCLOSURES

The views, opinions and content presented are for informational purposes only. The charts and/or graphs contained herein are for educational purposes only and should not be used to predict security prices or market levels. The information presented in this piece is the opinion of Aurdan Capital Management and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but we cannot guarantee the accuracy or completeness of the information, no liability is accepted for any inaccuracies, and no assurances can be made with respect to the results obtained for their use. The information contained herein may be subject to change at any time without notice. Past performance is not indicative of future results.