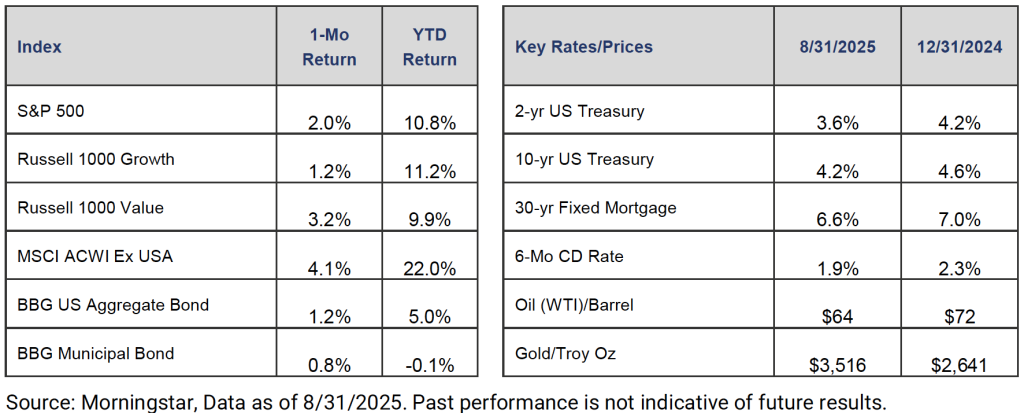

U.S. stocks rose for the fourth consecutive month in August. The S&P 500 gained 2.0% and closed the month near record highs. Value and small cap stocks benefited from a rotation out of high-flying tech stocks as the Russell 1000 Value and Russell 2000 gained 3.2% and 7.2%, respectively. International stocks also outperformed, rising 4.1%. Finally, the 10-year Treasury Note yield declined 15 basis points to end the month at 4.2%. The fall in rates pushed investment-grade bonds up by about 1% for the month.

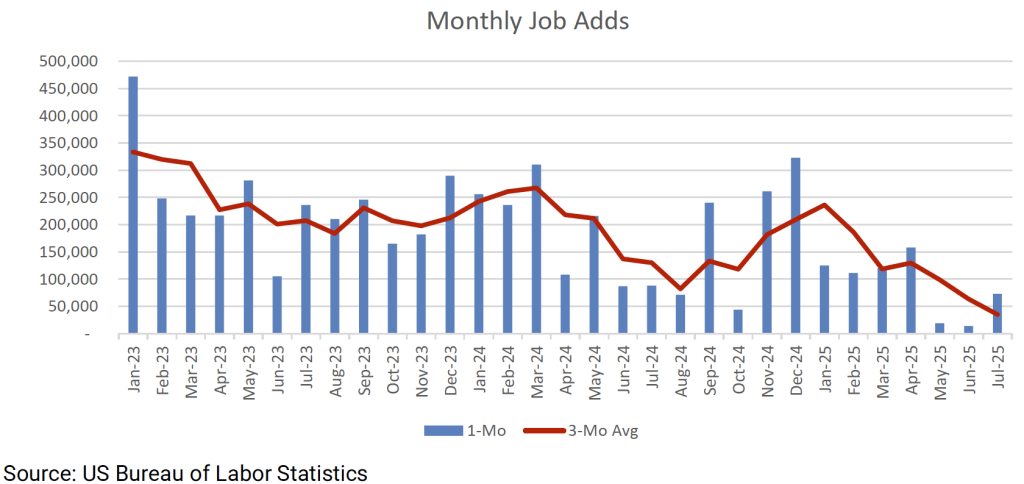

Monetary policy was front and center this month as the Federal Reserve (Fed) gathered in Jackson Hole, Wyoming for their annual symposium. Fed Chair Jerome Powell gave a speech where he characterized the economy as strong but did mention that the “balance of risks appear to be shifting” from inflation to labor markets. The comments followed a weaker-than-anticipated jobs report in early August that showed the US economy added just 35,000 jobs per month over the May, June, and July period.

The Fed has been on hold for eight months after implementing a string of rate cuts in late 2024 that lowered short-term rates from 5.4% to 4.4%. Following Powell’s speech, the market is assigning a 90% probability that the Fed will resume lowering rates at their September 17th meeting. For much of the past year, the Fed has focused on lowering inflation as the employment side of their dual mandate remained strong. Now, with job growth slowing, the market anticipates multiple rate cuts over the coming quarters with the Fed reaching the “neutral” rate of 3.0%, a level that is neither restrictive nor stimulative, by the end of 2026.

Historically, rate cuts have been beneficial for financial assets, lifting both stock and bond prices. The

economy and markets weathered a rough patch in the first half of 2025 as tariffs and restrictive monetary policy elevated uncertainty. Now, with the tariff picture becoming clearer and the Fed beginning to ease, the economy and markets could be set for a new leg higher over the rest of 2025.

IMPORTANT DISCLOSURES

The views, opinions and content presented are for informational purposes only. The charts and/or graphs contained herein are for educational purposes only and should not be used to predict security prices or market levels. The information presented in this piece is the opinion of Aurdan Capital Management and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but we cannot guarantee the accuracy or completeness of the information, no liability is accepted for any inaccuracies, and no assurances can be made with respect to the results obtained for their use. The information contained herein may be subject to change at any time without notice. Past performance is not indicative of future results.