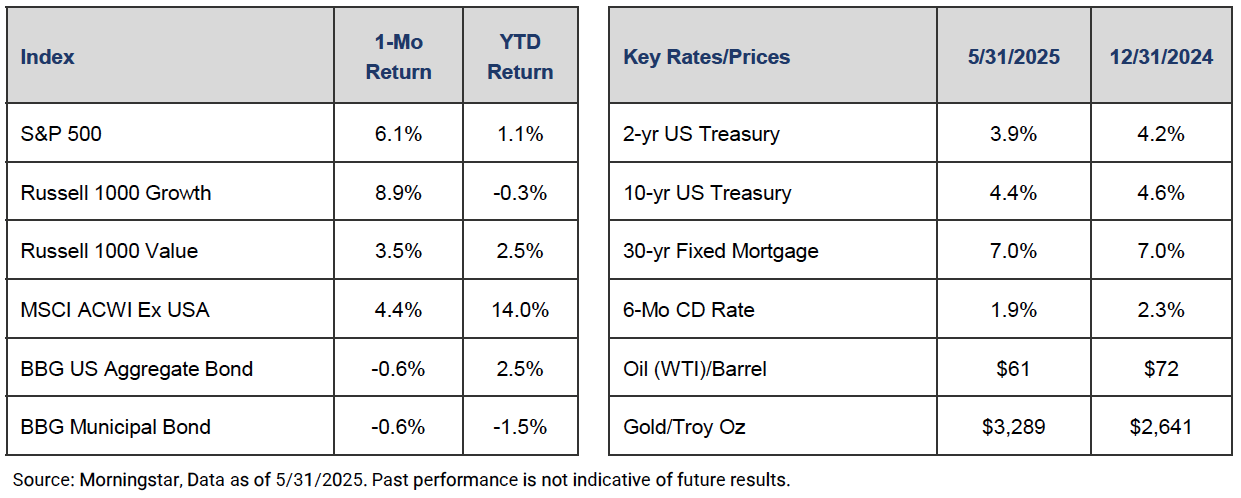

U.S. stocks continued to climb a wall of worry this past month. Despite threats of increased tariffs and concerns over the fiscal health of the U.S., the S&P 500 powered forward, finishing May 6.1% higher. The run was fueled by large cap tech and internet stocks as the Russell 1000 Growth rose 8.9%. International stocks also delivered a solid month as the MSCI ACWI ex USA gained 4.4%. Fixed income investors were not as fortunate as a 20-basis point rise in the yield on the 10-year Treasury Note led to negative returns for both taxable and tax-exempt bonds.

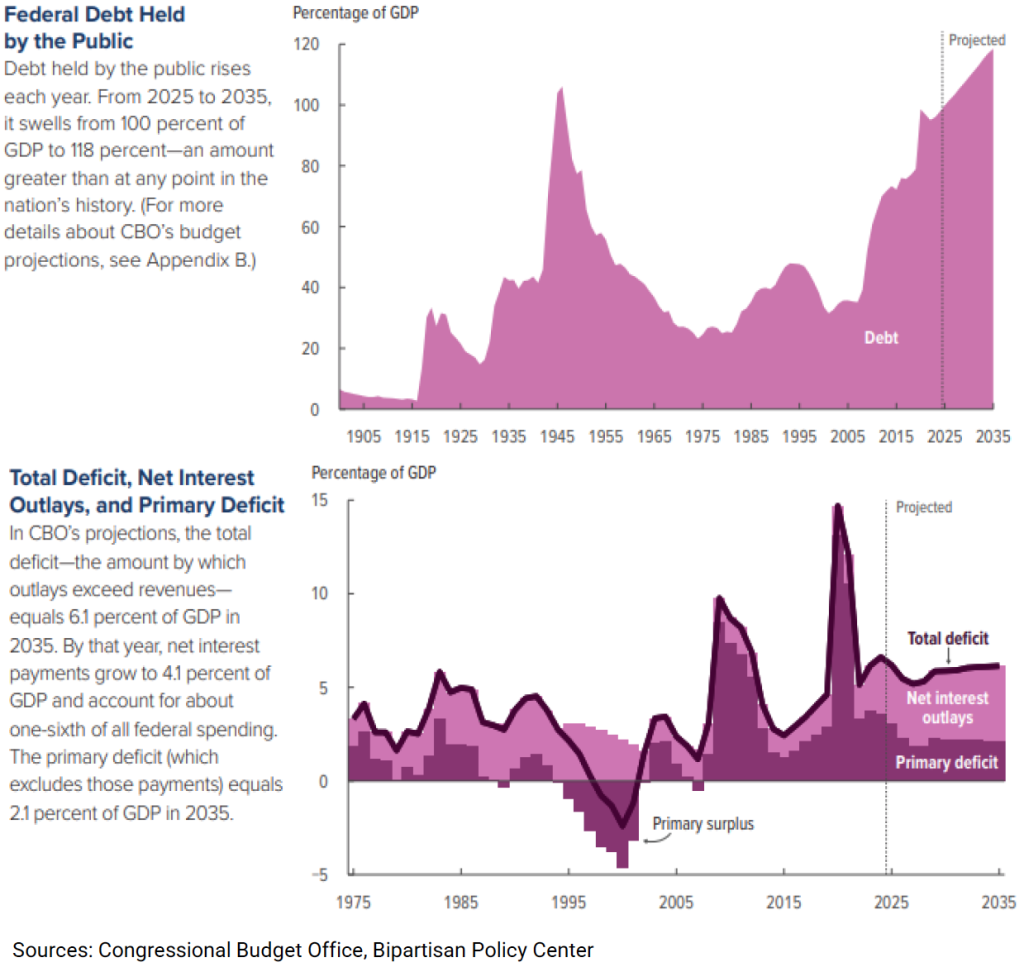

Fiscal policy in the form of tariffs and tax bills continued to dominate headlines in May. Arguably the most notable development was the passing of the new Republican tax bill through the House of Representatives. The bill is now making its way through the Senate. While it is likely elements of the bill will change over the next several months, we thought it useful to cover the main provisions found within the bill and their potential impacts and consequences.

The biggest provision found in the bill is making the tax cuts implemented through the 2017 Tax Cut & Jobs Act (TCJA) permanent. Income tax rates are set to rise to pre-2017 levels after this year without the passing of the new bill. The cost related to making the TCJA tax cuts permanent amounts to $2.2T over the next ten years. The bill also permanently extends the doubling of the standard deduction that was implemented through the TCJA. This will cost $1.3T over the next ten years. Other notable policies are the extension of the Child Tax Credit, raising the State and Local Tax (SALT) deduction from $10,000 to $40,000, and a $150 billion increase in defense spending. To offset a portion of the costs, the bill repeals personal exemptions, cuts tax credits for clean energy and electric vehicle purchases, and places stricter eligibility requirements on Medicaid and SNAP benefits.

All told, the tax bill is expected to increase the federal deficit by an additional $3.8 trillion over the next decade. Bond markets reacted negatively to the passing of the bill with the yield on the 10-year Treasury Note rising from 4.18% on April 30th to 4.55% on May 22nd before easing back to 4.40% by the end of the month. For now, it appears the U.S. can continue spending beyond its means, but at some point, the U.S. will be forced to balance its budget through spending cuts, tax increases, or a combination of the two.

https://www.cbo.gov/publication/60870

https://bipartisanpolicy.org/explainer/whats-in-the-2025-house-republican-tax-bill

IMPORTANT DISCLOSURES

The views, opinions and content presented are for informational purposes only. The charts and/or graphs contained herein are for educational purposes only and should not be used to predict security prices or market levels. The information presented in this piece is the opinion of Aurdan Capital Management and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but we cannot guarantee the accuracy or completeness of the information, no liability is accepted for any inaccuracies, and no assurances can be made with respect to the results obtained for their use. The information contained herein may be subject to change at any time without notice. Past performance is not indicative of future results.