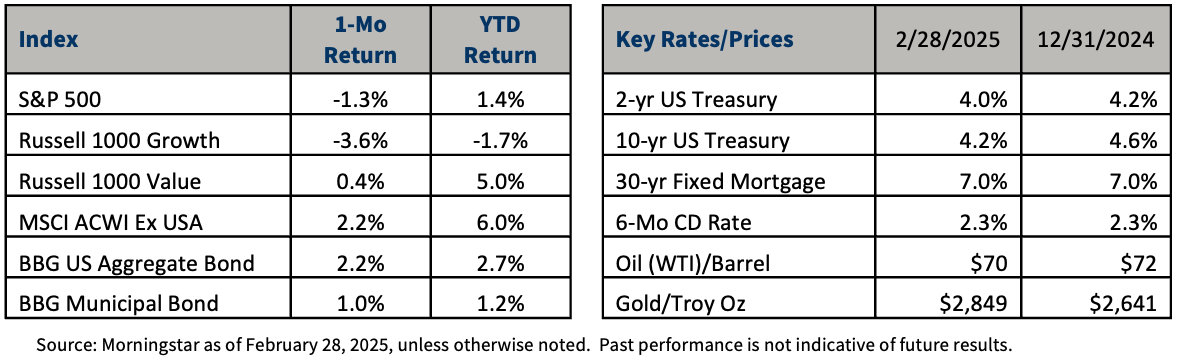

February brought negative returns for U.S. equities with the S&P 500 declining 1.3%. Value stocks outperformed for the second month in a row as the Russell 1000 Value gained 0.4% and the Russell 1000 Growth dropped 3.6%. Fears over tariffs and choppiness in highly valued technology names pushed volatility higher over the month. International stocks outperformed as the MSCI ACWI Ex USA rose 2.2%. Fixed Income also posted solid gains as the 10-year treasury yield fell 40 bps to 4.2%, pushing bond prices higher. Taxable bonds rose 2.2% in February while tax-exempt bonds increased 1.0%.

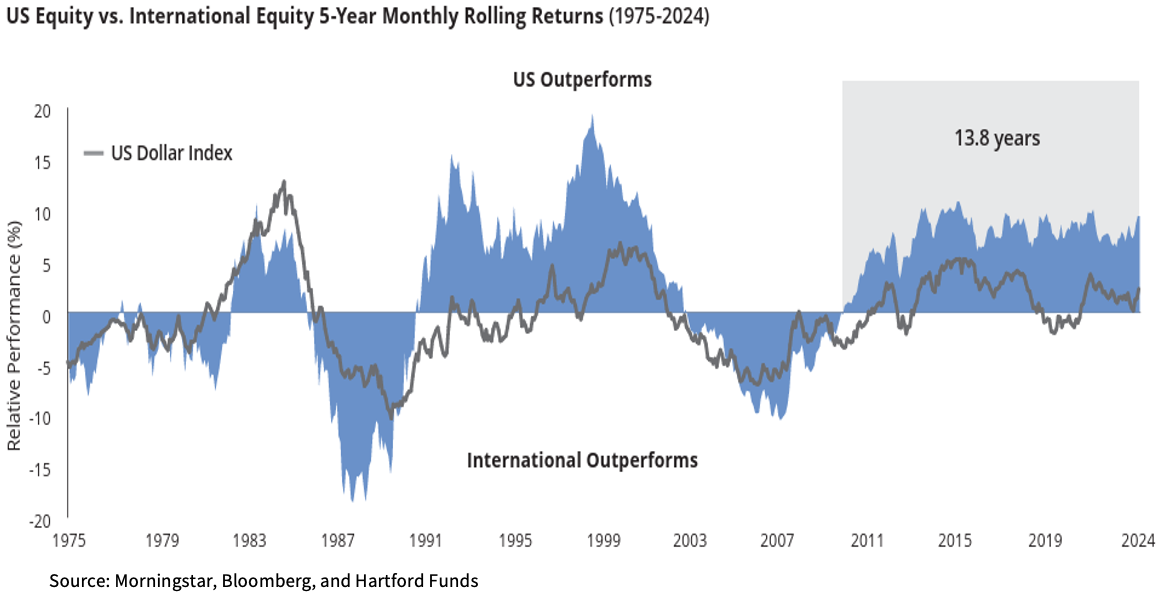

The first two months of 2025 marked the first stretch in quite some time that international stocks outperformed their U.S. counterparts. While the S&P 500 has gained just 1.4% year-to-date, the MSCI ACWI Ex USA surged 6.0%. Both developed and emerging markets are doing well as the MSCI EAFE, an index of companies located in regions like Europe, Japan, and Australia, increased 8.1%, and the MSCI Emerging Markets, an index of companies located in regions like China, India, and Brazil, gained 2.6%.

The main drivers behind the current rally in international stocks relates to valuations and currencies. The first factor is international markets are very cheap compared to U.S. markets. The U.S. currently trades at 22x earnings, which means for every $1 of earnings the U.S. stock market generates, investor will pay 22x to own the market. International markets are trading at just 14x, a 36% discount to the U.S. market. Historically, international’s discount to the U.S. has been about 18%, meaning international markets could outperform the U.S. by another 15-20% and only be back to historical averages.

The second factor relates to currencies. When a U.S.-based investor buys international stocks, they are effectively selling dollars and buying stocks priced in foreign currencies like the Euro and Yen. This means if the foreign currencies appreciate versus the dollar, it enhances the return to the U.S.-based investor. If the foreign currencies depreciate versus the dollar, it lessens the total return to the U.S.-based investor. The U.S. dollar has been exceptionally strong the past few years, which has dampened international returns. In 2024 alone, the dollar strengthened 6.4% against a basket of foreign currencies, presenting a sizable headwind to investors. So far in 2025, the dollar has weakened against the same basket of currencies by 1.0%, providing a tailwind to U.S.-based investors. Despite the recent rally in foreign currencies, the dollar is not far off its strongest level since the early 2000s. A return to historical averages of dollar strength could provide another 5-10% tailwind to international stocks.

International allocations have been a drag on investors’ portfolios for the past decade as U.S. markets dominated international peers. This has left many investors overweight U.S. companies and the dollar and underweight international companies and their currencies. We have maintained positions in both developed and emerging market stocks as they provide diversification from a company, country, and currency perspective. A period of international outperformance could lead overexposed U.S. investors to reevaluate their allocations, leading to increased capital flows to international stocks and pushing prices higher. If you have any questions on international investment or your allocation to international stocks, please reach out to a member of our team.

IMPORTANT DISCLOSURES

The views, opinions and content presented are for informational purposes only. The charts and/or graphs contained herein are for educational purposes only and should not be used to predict security prices or market levels. The information presented in this piece is the opinion of Aurdan Capital Management and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but we cannot guarantee the accuracy or completeness of the information, no liability is accepted for any inaccuracies, and no assurances can be made with respect to the results obtained for their use. The information contained herein may be subject to change at any time without notice. Past performance is not indicative of future results.