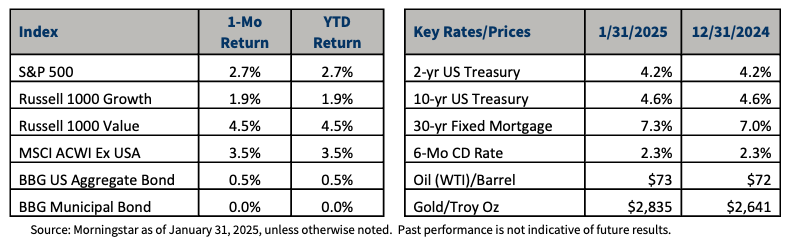

Stocks started strong out of the gate this year, with the S&P 500 posting a 2.7% return in January. Value stocks outperformed, a theme that has been largely dormant since the 2022 selloff, as the Russell 1000 Value Index gained 4.5%. International stocks were also strong, rising 3.5% as the strength of the dollar that has plagued international returns abated for the month. Taxable fixed income posted modest returns as core bonds rose 0.5% while investment-grade tax-exempt bonds were flat.

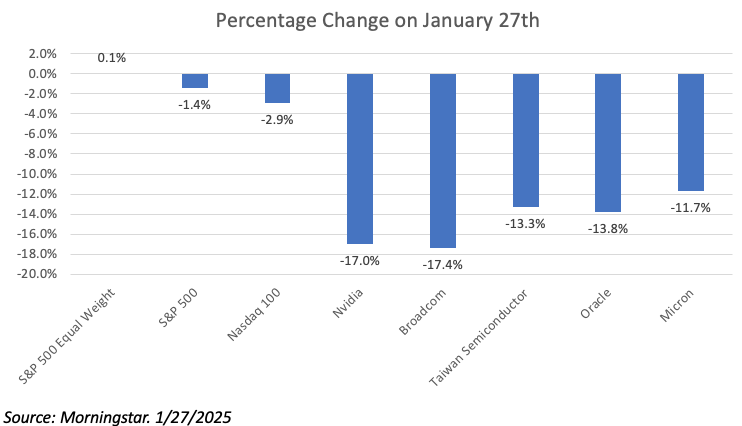

While the market posted solid returns in January, volatility came roaring back to kick off the year. DeepSeek became a household name in January as it quickly surpassed OpenAI to become the most downloaded app in the U.S. DeepSeek is a Chinese artificial intelligence (AI) company that designs open-source large language models (LLM). The company managed to develop an LLM that performs tasks at the same level as OpenAI’s ChatGPT but at a fraction of the cost. This news sent U.S. technology stocks into a tailspin the last week of the month as investors swiftly reevaluated the investment thesis behind AI stocks. Nvidia, the poster child for the AI-powered bull market run over the past two years, lost 17%, or nearly $600 billion in market value, in just one day. Other high-flying technology names like Broadcom and Oracle also declined by double digits.

The recent selloff in technology stocks has served as a crucial reminder of the importance of diversification. Since these companies make up a concentrated portion of the broad stock index, when they struggle, the broader market often follows suit. In contrast, as shown in the chart above, the S&P 500 Equal Weight Index delivered a slightly positive return on the same day, highlighting the benefits of a more balanced approach to investing. This reinforces the value of diversification in helping to mitigate risks during periods of volatility, as different sectors and assets classes react differently to market conditions.

This volatility in tech stocks is reminiscent of the dot-com boom 25 years ago. In the 1990s, analysts predicted that the internet would revolutionize business and the world, and while that prediction turned out to be accurate, many early internet companies ultimately became worthless. A similar trend is unfolding with AI today. While AI is poised to transform business and society, it’s still unclear which companies will emerge as the leaders in this space. Many investors now hold large positions in AI stocks, after their significant price increases over the past two years. Given the uncertainty, maintaining a diversified portfolio remains crucial, balancing long-duration growth stocks with defensive, attractively valued companies that are generating strong cash flow today.

While we have increased our allocation to growth stocks, we’ve consistently balanced this with defensive value stocks to provide stability in case of a pullback in the technology sector. Additionally, we use fixed income and alternative investments to offer stability and non-correlated returns in client portfolios.

If you have any questions or concerns regarding the markets or your portfolio, please reach out to a member of the Aurdan Capital Management team.

IMPORTANT DISCLOSURES

The views, opinions and content presented are for informational purposes only. The charts and/or graphs contained herein are for educational purposes only and should not be used to predict security prices or market levels. The information presented in this piece is the opinion of Aurdan Capital Management and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but we cannot guarantee the accuracy or completeness of the information, no liability is accepted for any inaccuracies, and no assurances can be made with respect to the results obtained for their use. The information contained herein may be subject to change at any time without notice. Past performance is not indicative of future results.