As the year comes to a close, we often take this time to reflect on the many accomplishments and milestones we’ve achieved. We are incredibly grateful for the support and encouragement from our family, clients, friends, and network, which have been instrumental in helping us launch Aurdan Capital Management. Starting a business is no easy feat, and we couldn’t have done it without the hard work and dedication of the Aurdan team. We are pleased to report after our first six months we are off to a successful start. Looking ahead, we’re excited to announce plans to make our first hire in the first quarter of 2025. This new team member will be dedicated to our wealth planning efforts. Stay tuned for more details!

We extensively covered the potential impact of higher interest Looking back on the past twelve months, it’s clear that the financial markets and economy have experienced a truly eventful year. The markets have continued to reach new heights, surpassing even the most optimistic forecasts. A new political administration is preparing to take charge, inflation has proven persistent, and the economy remains in relatively strong shape. The market themes that dominated 2023, Artificial Intelligence, Mag 7, large cap technology, remained in 2024.

As we look ahead, the central themes for next year will remain closely tied to the tech cycle and ongoing advancements in AI. We will closely monitor the Federal Reserve’s actions, inflation trends, and the potential policy shifts under the new administration. It is during times like these we are reminded that successfully navigating the markets requires a balance of optimism, caution, and adaptability.

Reminder of our new office location and contact information.

Aurdan Capital Management 1550 Liberty Ridge Drive | Suite 280Wayne, PA 19087

Eric Hildenbrand (484)254-1940

ehildenbrand@aurdancapital.com

Steve Mills (484)254-1939

smills@aurdancapital.com

Robert Stiles (484)254-6201

rstiles@aurdancapital.com

Roseann Dittmar (484)254-1941

rdittmar@aurdancapital.com

Sam McCaffrey (484)254-1942

smccaffrey@aurdancapital.com

Looking back on the past twelve months, it’s clear that the financial markets and economy have experienced a truly eventful year. The markets have continued to reach new heights, surpassing even the most optimistic forecasts. A new political administration is preparing to take charge, inflation has proven persistent, and the economy remains in relatively strong shape. The market themes that dominated 2023, Artificial Intelligence, Mag 7, large cap technology, remained in 2024.

As we look ahead, the central themes for next year will remain closely tied to the tech cycle and ongoing advancements in AI. We will closely monitor the Federal Reserve’s actions, inflation trends, and the potential policy shifts under the new administration. It is during times like these we are reminded that successfully navigating the markets requires a balance of optimism, caution, and adaptability.

The Economy

The economy has not changed much since our last quarterly commentary. There has been some mild softening in labor market statistics, but growth remains above trend and absolute levels of employment are strong.

Real GDP expanded an annualized 3.1% in Q3 2024 after rising by 3.0% in Q2. The Federal Reserve’s GDPNow model is projecting another 3.1% growth rate in Q4. These are strong growth numbers and are well above the estimated long-term trend growth rate of roughly 2.0%. Growth has been propelled by a resilient consumer, who has continued to spend in the face of high interest rates and inflation. Also helping growth is investment spending on the build out of AI infrastructure, such as data centers and energy assets, as well as reshoring initiatives targeting manufacturing and the supply chain.

The unemployment rate has remained stable in the low-4% for over six months, with November 2024 unemployment coming in at 4.2%. This figure is up from a historical low of 3.4% reached in January 2023 but indicates a healthy level of employment on a historical basis. Yet, there have been some signs of softening in the labor market over the past quarter. The main data points indicating this are continuing unemployment claims reaching a three-year high and hire rates hovering near five-year lows excluding COVID. Employers are reluctant to let employees go after the labor shortage experience in 2021 and 2022. However, they are hesitant to hire new workers given the high-interest rate environment, a new administration taking office in 2025, and geopolitical issues muddying business outlooks. This dynamic has resulted in what economists are calling “The Great Stay”, where employee turnover decreases as the difficulty of finding a new job increases.

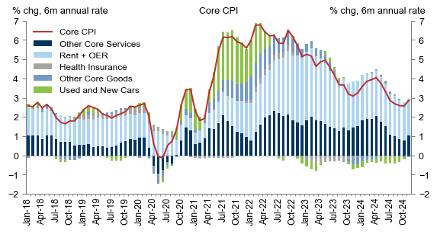

Finally, progress on inflation stalled this past quarter, as the Core Consumer Price Index (CPI) came in at 3.3% year-over-year in November. Core CPI has been in the low-3% since May and has not made progress towards the Fed’s 2.0% mandate for over six months. Service inflation has been the thorn in the Fed’s side as prices for housing, rents, and insurance have continued to increase at a faster pace than pre-COVID.

While there are some cracks appearing in the labor market, overall, the economic outlook looks healthy. Above-trend growth, elevated inflation, and a low unemployment rate are all indicators of a supportive backdrop for risk assets like equities and credit.

The Fed was active in the fourth quarter, cutting two times for a total of 0.50%. The back-to-back cuts in November and December followed a 0.50% cut in September. In total, the string of cuts over the past four months lowered the Fed’s short-term rate from 5.4% to 4.4%. While inflation remains above target, the Fed felt their short-term rate was too restrictive and opted for what some are calling a “mid-cycle adjustment” to better align rates with the current economic environment

As discussed earlier, inflation remains above target and growth is above trend. These data points influenced the Fed’s latest dot plot, an aggregation of committee members interest rate outlook. The Fed now sees just two cuts in 2025 which would leave their short-term rate at 3.9% by year end. This was a big change from their previous dot plot where they projected four cuts in 2025. Influencing this was the Fed’s outlook for the economy, with the committee seeing 2.5% inflation next year, 2.1% real GDP growth, and a 4.3% unemployment rate. The Fed thinks the good times will continue to roll next year, and as such, is taking a more cautious approach to monetary easing going forward.

Equities

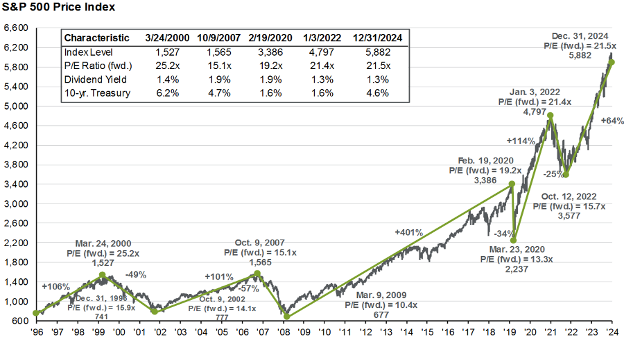

Stock prices continued to rise in the fourth quarter as rate cuts, strong projected earnings, and the conclusion of the 2024 elections kept investor optimism high. The S&P 500 rose another 2.4% in the fourth quarter, bringing the index’s annual return to 24.9%. 2024 was much like last year as technology and artificial intelligence stocks drove the market higher. This led to another year of growth outperforming value and large cap outperforming small cap. International stocks were not as fortunate as weaker economic growth and a strong U.S. dollar weighed on performance, with the MSCI ACWI Ex USA falling 7.5% in Q4 and gaining just 5.2% on the year.

Looking forward, high valuations and concentration in U.S. stocks gives us pause. The S&P 500 is trading at 21x forward earnings, well above the historical average of 17x, and the top ten stocks account for 39% of the index. The market is also pricing in rosy expectations for next year, with analysts anticipating 15% earnings growth. While having exposure to stocks poised for future growth is important, it is also prudent to allocate to stocks that have attractive valuations and earnings streams in the here and now. Defensive, high-quality, dividend paying stocks pair well with the growth and technology-exposed indexes like the S&P 500 and Nasdaq. Defensive stocks can protect during times of market stress and provide a smoother ride for equity investors.

Fixed Income & Alternatives

Fixed income experienced another tough quarter as interest rates pushed higher post-election. The 10-year Treasury yield rose from 3.8% to 4.6% over the quarter, causing bond prices to fall. The Bloomberg U.S. Aggregate Bond, an index of taxable debt, fell 3.1% while the Bloomberg Municipal Bond, an index of tax-exempt debt, declined 0.9%. Returns for the year were muted, with both indexes gaining just 1.3%. Concerns over inflation, the level of government borrowing, and less future rate cuts all led to higher rates over the quarter and will likely keep a floor on how low rates will go in 2025. Despite the lackluster returns, core bonds still offer yields in the 5% range and can provide ballast to a portfolio in times of market stress. Conservative and income-focused investors should maintain allocations to core bonds despite the challenging environment of the past few years.

We have mentioned in previous quarterly letters that we have been increasing our focus on alternative investments. These private market alternatives tend to offer high income and returns with low correlation to public market assets. One area we have been pleased with over the past year is our allocation to private credit. Direct lending, where managers lend capital directly to privately owned companies, has been a solid income producer with low volatility. To compare, direct lending returned roughly 13% in 2024 while core bond indexes returned just 1%. We have been reviewing other potential alternative investments in private equity, infrastructure, and real estate to see if they can enhance client portfolios as well.

Artificial Intelligence

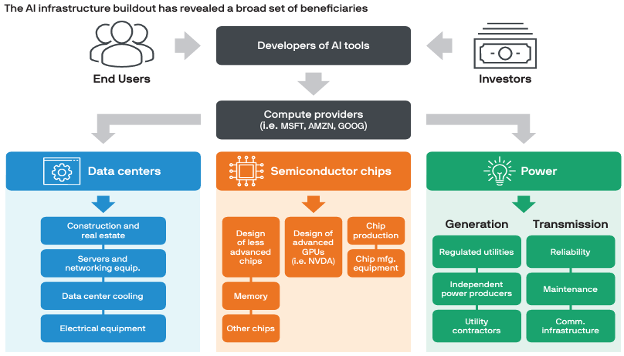

The biggest driver of market performance over the past two years has been the rapid development and monetization of artificial intelligence (AI). ChatGPT, OpenAI’s generative artificial intelligence chatbot, launched in November 2022 and sparked the rapid release of other generative AI tools over the next two years such as Google’s Gemini, Anthropic’s Claude, and Elon Musk’s xAI. While these generative chatbots are the primary way people interact with AI, there are numerous other beneficiaries under the surface. The biggest and most well-known has been Nvidia, which designs the graphics processing units (GPUs) that are used to train and run the generative AI models. Nvidia’s share price has surged over 800% in the past two years and is now the second largest company in the world.

Other beneficiaries have been the cloud service providers that offer cloud computing and data management to end clients. This cohort includes names like Amazon, Microsoft, and Google. Branching out further are data centers, the companies that make the electrical and cooling equipment in data centers, semiconductor companies that make the various chips and networking equipment besides GPUs found in data centers, and finally, the power providers like regulated utilities and contractors that provide energy and services to data centers. Looking forward, potential beneficiaries could be the companies that own copious amounts of data that would be useful for AI models to analyze. Examples of these companies would be financial services firms, healthcare providers, social media platforms, marketing agencies, and rating agencies.

It is likely we are only in the early innings of the AI era, with ultimate winners and losers still unknown. The market has quickly rewarded companies poised to capture share of the AI market, with names like Nvidia, Microsoft, Amazon, and Google surging over the past two years. These names now account for a large portion of the broader stock market index, leaving investors exposed should these companies end up being surpassed by newcomers in the AI space. Given this risk, it is important to have exposure to these names while having diversified allocations to other areas of the market should these technology behemoths begin to lose their market share.

Conclusion

Despite challenges such as ongoing inflation and a cooling labor market, the outlook remains cautiously optimistic, driven by robust GDP growth and resilient consumer spending. As we move into 2025, technological advancements—particularly in AI—will continue to influence market trends, presenting both opportunities and risks. However, we must remain mindful that if inflation continues and deficits widen, interest rates are likely to rise, which could shift attention away from the stock market. Many uncertainties persist, including potential policy changes under the incoming Trump administration and escalating geopolitical tensions. At Aurdan Capital, we maintain a balanced approach, participating during favorable conditions while protecting in case market dynamics shift. Due to this, we continue our research on alternative assets that will not respond in-kind with possible stock or bond volatility.

We wish everyone a safe and happy New Year in 2025!

– The Aurdan Capital Management Team

IMPORTANT DISCLOSURES

The views, opinions and content presented are for informational purposes only. The carts and/or graphs contained herein are for educational purposes only and should not be used to predict security prices or market levels. Advisory services offered through Aurdan Capital Management, LLC., an Investment Adviser registered with the U.S. Securities & Exchange Commission. The information presented in this piece is the opinion of Aurdan Capital Management and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but we cannot guarantee the accuracy or completeness of the information, no liability is accepted for any inaccuracies, and no assurances can be made with respect to the results obtained for their use. The information contained herein may be subject to change at any time without notice. Past performance is not indicative of future results.

Use of the Russell indices

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. Russell® is a trademark of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor, or endorse the content of this communication.

Use of the MSCI Inc. and S&P Global Market Intelligence Global Industry Classification Standard (“GICS”) sectors

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and service market of MSCI Inc. (“MSCI”) and S&P Global Market Intelligence (“S&P”) and is licensed for use by Aurdan Capital Management, LLC. Neither MSCI, S&P, nor any party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability, and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential, or any other damages (including loss of profits) even it notified of the possibility of such damages.