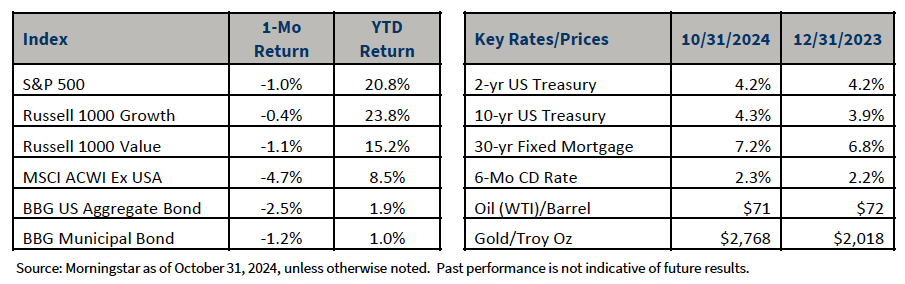

Stocks finished October slightly in the red after selling off in the last week of the month. The market is taking a wait-and-see approach as we head into November’s Presidential Election and Federal Reserve (Fed) meeting. The S&P 500, an index of large U.S. companies, fell 1.0%, while the Russell 2000, an index of smaller U.S. companies, declined 1.4%. International stocks, represented by the MSCI ACWI Ex USA Index, fell 4.7% as a stronger dollar and weaker economic growth overseas negatively impacted foreign companies.

Fixed income sold off in October as higher interest rates weighed on bond prices. The prospects of sticky inflation and elevated federal deficits resulted in the 10-Year Treasury Bond yield rising 0.5% over the month. The Bloomberg U.S. Aggregate Bond Index, a proxy for the taxable bond market, fell 2.5%, while the Bloomberg Municipal Bond Index, a proxy for the tax-exempt bond market, declined 1.2%.

All eyes now turn to the week ahead where we will see the 2024 Presidential Election on Tuesday, November 5th and the penultimate Federal Reserve meeting of 2024 on Thursday, November 7th. The election continues to be extremely close, with both candidates possessing a reasonable chance of attaining 270 electoral votes. The battle to control Congress also remains tight according to most recent polls. The most likely outcome is a divided government, which would see one party control the White House and another party control at least one chamber of Congress. Financial markets like divided governments as it prevents either party from having carte blanche to enact their fiscal and legislative policies.

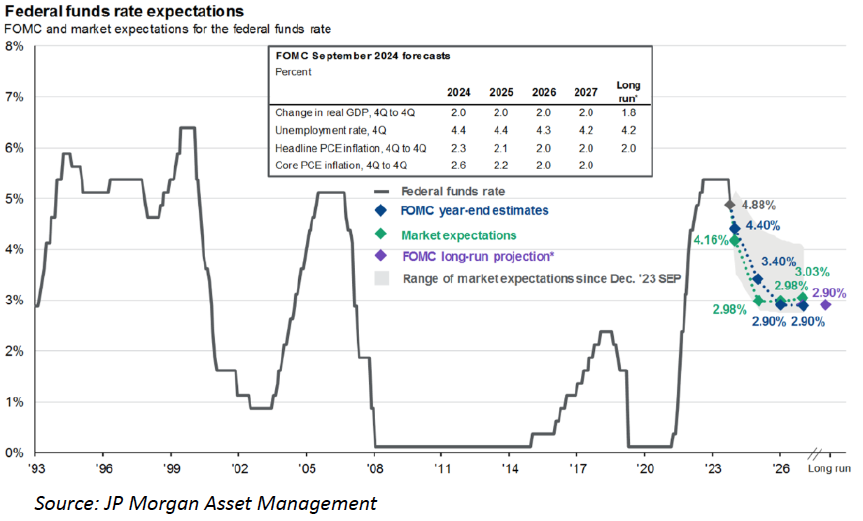

The other consequential event in the first week of November is the Federal Open Market Committee meeting. The Fed is widely expected to cut interest rates by 0.25%. This follows their oversized cut in September when they lowered the Federal Funds Rate by 0.50% from 5.3% to 4.8%. Core inflation is now running around 3.0% on an annual basis, down significantly from the high-single-digit prints we saw in 2022. However, price pressures remain above the Fed’s long-term target of 2.0%. The combination of still elevated but declining inflation has prompted the Fed to start a mid-cycle adjustment, where they will methodically adjust monetary policy from a restrictive position to a more neutral stance. Growth and employment remain strong, which allows the Fed to be patient with their monetary moves. Should growth and employment begin to deteriorate, the Fed has a sizable cushion to quickly cut rates to stave off a downturn. The Fed is expected to cut twice more in 2024, bringing the policy rate to 4.4% by year-end. The committee is then expected to cut three to four more times in 2025, bringing the rate to a neutral level of around 3.4%.

IMPORTANT DISCLOSURES

The views, opinions and content presented are for informational purposes only. The charts and/or graphs contained herein are for educational purposes only and should not be used to predict security prices or market levels. The information presented in this piece is the opinion of Aurdan Capital Management and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but we cannot guarantee the accuracy or completeness of the information, no liability is accepted for any inaccuracies, and no assurances can be made with respect to the results obtained for their use. The information contained herein may be subject to change at any time without notice. Past performance is not indicative of future results.